投资

5

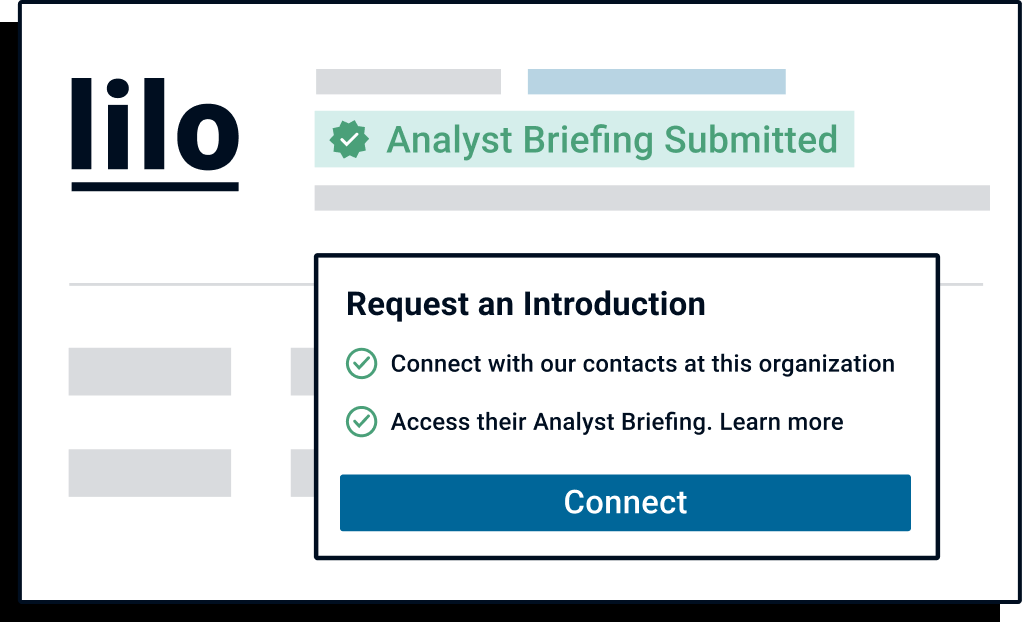

想告知投资者类似雷恩合资企业关于你的公司吗?

提交你的分析师简报在投资者面前,CB Insights的平台上的客户和合作伙伴。德赢体育vwin官方网站

最新的雷恩合资企业新闻

2023年5月19日,

迈克尔·里根2022年11月/盖蒂图片社,格雷泽家族宣布,他们正在考虑出售足球俱乐部曼联。家庭,也拥有NFL的坦帕湾海盗队,表示会考虑所有的战略替代方案,包括“新投资俱乐部,出售或其他涉及到公司的事务,”在一份声明中说。经过六个月的谈判和报价,决议仍悬而未决的格雷泽家族没有一个统一的决定他们会与俱乐部,据知情人士透露,这一过程。他们将审查所有的选项在5月底EPL的2022 - 23个赛季。格雷泽家族的曼联拥有20年前开始当末马尔科姆·格雷泽收购俱乐部2.9%的股份以约560万美元(£900万)。亿万富翁提出正式收购不到两年后,当他的股份达到57%,他执行一个杠杆收购俱乐部的2005年为15亿美元,获得98%的股份。在收购期间,7.87亿美元的债务是合并到俱乐部的书。俱乐部的债务到2010年达到10亿美元,尽管球迷强烈反对,这个家庭通过发行债券融资债务价值约£5亿。债券发行后,家庭选择了IPO,和曼联首次于2012年在纽约证券交易所上市,筹集2.33亿美元。IPO给红魔市值约23亿美元。 At the time of the IPO, the family represented 67% of the voting power, holding class B shares with 10 votes each, thus maintaining control of the club. The 2012-13 season was the last time Red Devils won the Premier League. Here’s what has happened since then. Manchester United Sale Timeline May 2013: The club’s legendary manager, Sir Alex Ferguson, announces that he will retire after 26 years at the helm. During his tenure, the club won 38 trophies, including 13 Premier League titles, five FA Cups and two UEFA Champions League titles. Ferguson is the most successful manager in British football history. May 2014: Malcolm Glazer dies. The family sells 12 million more shares at $17 for $200 million (£129 million). In December, Edward Glazer sells 3 million of his shares. Amid fan anger, the Glazers rule out selling Manchester United for at least five years. August 2017: Through the holding company Red Football, the Glazers sell 4.3 million shares for $17 a share. They make $73 million (£58 million) from the sale. March 2021: Avram Glazer, the co-chairman, sells 5 million Class A shares worth around $100 million (~£70 million). October 2021: Avram’s brothers Kevin and Edward Glazer have sold 9.5 million shares at a price of $16.98 per share, netting a total of $161 million (£117 million). November 2022: The family announces it is “commencing a process to explore strategic alternatives for Manchester United,” in a statement during the annual investors meeting . $MANU shares were up more than 8% in pre-market trading and finished the day at $18.80, up more than 25%. The day before, shares rallied 15% on the news that Cristiano Ronaldo and the team mutually agreed to split. December 2022: The family hires Raine Group to oversee the sale process. Raine facilitated the Chelsea sale the previous March. February 2023: Raine Group sets a deadline for the first round of bids, and Man United stock jumps 10%. Since the Glazers announced a potential sale in November, $MANU stock value has more than doubled. At this point, the enterprise value of the club, including net debt, is $5.2 billion. Qatari investor Sheikh Jassim Bin Hamad Al Thani and INEOS founder Jim Ratcliffe are the only parties to publicly declare their intent to bid on Manchester United, but several other bids are submitted. Al Thani is the chairman of Qatari Islamic Bank and the son of the country’s former prime minister. Ratcliffe is the richest man in the U.K., worth $15.3 billion, according to Forbes. They are both lifelong fans of the club. March 2023: The club reports revenue of $206 million (£167 million) for its second quarter (representing the three months ending Dec. 31, 2022), a 10% drop from the prior year, driven by the club’s absence from the Champions League and a resulting a decline in broadcast revenues. Net profit for the quarter is $7.7 million. April 2023: In April, Raine receives the second round of bids. Both Al Thani and Ratcliffe are in this group, along with six more bids, including the Finnish businessman and former Nokia executive Thomas Zilliacus. As part of his bid, Zilliacus says he will invite Manchester United supporters from around the world to be co-owners. Raine reportedly gives feedback to these bidders ahead of the third round of the bidding process. At the end of April, Raine accepts a third round of bids, and five parties submit, including Al Thani and Ratcliffe. Zilliacus leaves the bidding process. Raine Group declined to comment for this article. Read More About:

雷恩企业投资

5投资

雷恩冒险了5投资。他们最新的投资岩石的钟声作为他们的一部分B系列在2023年4月4日。

雷恩企业投资活动

日期 |

轮 |

公司 |

量 |

新的吗? |

共同投资者 |

来源 |

|---|---|---|---|---|---|---|

|

4/17/2023 |

B系列 |

岩石的钟声 |

15美元 |

是的 |

3 |

|

|

8/15/2022 |

一个系列 |

|||||

|

6/9/2022 |

B系列 |

|||||

|

3/17/2022 |

一个系列 |

|||||

|

3/3/2022 |

B系列 |

发现正确的解决方案为您的团队

CB见解德赢体育vwin官方网站科技市场情报平台分析数百万数据点在供应商、产品、合作关系,专利来帮助您的团队发现他们的下一个技术解决方案。