投资

25投资退出

2

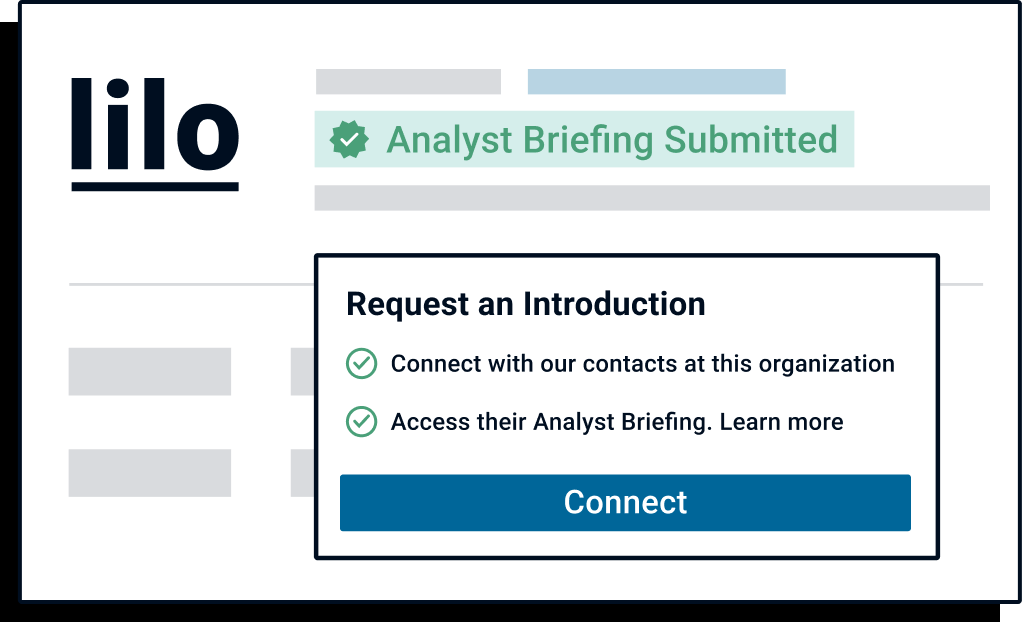

想告知投资者类似Immad洪德关于你的公司吗?

提交你的分析师简报在投资者面前,CB Insights的平台上的客户和合作伙伴。德赢体育vwin官方网站

最新的Immad洪德新闻

2023年5月11日,

Immad洪德、汞的汞的联合创始人和首席执行官银行业的未来可能的fintech实际上不是一个银行吗?这就是Immad洪德、汞的首席执行官说。六年前他创立了水星的目的,使银行更用户友好的初创公司。洪德SVB说他认为水星的对手,但直到3月,它肯定不是一个公平的战斗。虽然SVB以前约1750亿美元的存款银行挤兑,汞约有100000客户和是一个远比四十岁的SVB低调的实体。但很快,一切都改变了。SVB几周后坠毁,前SVB客户和跳跃的储户在硅谷一直在寻找新的银行分散回家。数字银行如汞、Brex和弧涌入大量客户,与汞看到最高存款冲向SVB几周后下跌超过20亿美元。Brex提供商业银行帐户,本周表示,它增加了3000名新客户后SVB倒塌。“我们仍然得到一个每周注册和存款数量的提升,“洪德解释道。 Mercury’s client base consists largely of early-stage startups that historically have not been serviced well by big banks like JPMorgan Chase. “Big banks just don’t really understand that the needs [of early-stage startups] are unique and a little weird,” Akhund explained. Another group he’s targeting are emerging managers, who are newer partners with smaller fund sizes who also were served well by SVB and First Republic but are wary of service at bigger banks. To woo them, Immad explained that they’re doing a range of services to make their user experience easier. For example, Mercury is allowing VCs to have one email address attached to multiple organizations, a small adjustment that will help avoid a common hassle, according to Akhund. Yet getting deposits and keeping them are two different things, especially when startups, VCs, and retail customers are in a flight to safety across the board. To keep their influx of customers and stand out from the crowd, Mercury raised their FDIC insurance ceiling up to $5 million up from $1 million before SVB collapsed. How? Mercury is not a chartered bank, and therefore can’t lend against deposits. To operate like a bank, they partner with regional bank networks and hold deposits there. Mercury’s two main bank partners are North Dakota-based Choice Bank and Tennessee-based Evolve. Both of these banks have a network of regional banks in its network, so they can spread out a customer’s $5 million across multiple accounts that are each under the $250,000 FDIC insurance threshold. “When you think about the future of serving a startup and getting safety for uninsured deposits, the only way they get that is either they go to a big bank that’s ‘too big to fail,’ or they go to somewhere like Mercury where they can get a larger set of FDIC insurance,” Akhund explained. Even while regional banks are the exact lenders that have been facing instability in recent weeks, Akhund still sees their strategy as fail-proof because their deposits largely stay in FDIC-insured accounts. He says that the amount of uninsured deposits across Mercury is “relatively small.” Yet not everyone is sure that Mercury will be able to keep its depositors happy long term. “Mercury is basically building a bank on a lot of third-party rails,” said fintech investor and general partner Matt Streisfeld at Oak HC/FT. “There were a bunch of deposits into Mercury and I think that’s great, but is there going to be another big slug of funds transitioning to them? I’m not sure,” he said. He explained that until their lending programs are more robust, and for some fintechs, until they’re lending at all, it’s hard to see them becoming the bank of choice for a majority of startups. “I just don’t know how sticky that’s gonna be,” he added. Akhund explained that Mercury started its venture debt lending business about a year ago, but isn’t yet able to meet the amount of demand. “We’re scaling it, but we’re not going to totally fill that SVB hole,” he explained. However, Akhund said he sees customers sticking around. “There was definitely a lot of flux at first and people were concerned about what is safe after SVB fell, but I would say recently, after that first week, our response with the increased FDIC made people feel really good about where we were positioned,” Akhund explained. For Akhund, he doesn’t see other fintechs as competition. “Strangely, we’re in a very uncompetitive space, and that’s the weird thing for people to see,” he explained. “You know, SVB was our main competitor.” Until next time,

Immad洪德投资。

25的投资

Immad洪德了。25的投资。他们最新的投资T2社会作为他们的一部分种子在2023年1月1日。

Immad洪德投资活动。

日期 |

轮 |

公司 |

量 |

新的吗? |

共同投资者 |

来源 |

|---|---|---|---|---|---|---|

|

1/13/2023 |

种子 |

T2社会 |

$1.1百万 |

是的 |

2 |

|

|

11/1/2022 |

种子风投 |

AiPrise |

2美元 |

是的 |

2 |

|

|

5/16/2022 |

种子风投 |

Topship |

2.5美元 |

是的 |

8 |

|

|

3/3/2022 |

一个系列 |

|||||

|

1/26/2022 |

种子风投 |

日期 |

1/13/2023 |

11/1/2022 |

5/16/2022 |

3/3/2022 |

1/26/2022 |

|---|---|---|---|---|---|

轮 |

种子 |

种子风投 |

种子风投 |

一个系列 |

种子风投 |

公司 |

T2社会 |

AiPrise |

Topship |

||

量 |

$1.1百万 |

2美元 |

2.5美元 |

||

新的吗? |

是的 |

是的 |

是的 |

||

共同投资者 |

|||||

来源 |

2 |

2 |

8 |

Immad洪德投资退出

2投资退出

Immad洪德有2投资组合出口。他们最新的投资退出中庭 在2020年4月6日。

日期 |

退出 |

公司 |

估值

提交的估值公司,采自国家申请或者新闻,由VentureSource的提供,或基于比较数据的估值模型。

|

收购者 |

来源 |

|---|---|---|---|---|---|

|

4/6/2020 |

Acq -人才 |

1 |

|||

日期 |

4/6/2020 |

|

|---|---|---|

退出 |

Acq -人才 |

|

公司 |

||

估值 |

||

收购者 |

||

来源 |

1 |

发现正确的解决方案为您的团队

CB见解德赢体育vwin官方网站科技市场情报平台分析数百万数据点在供应商、产品、合作关系,专利来帮助您的团队发现他们的下一个技术解决方案。