投资

2

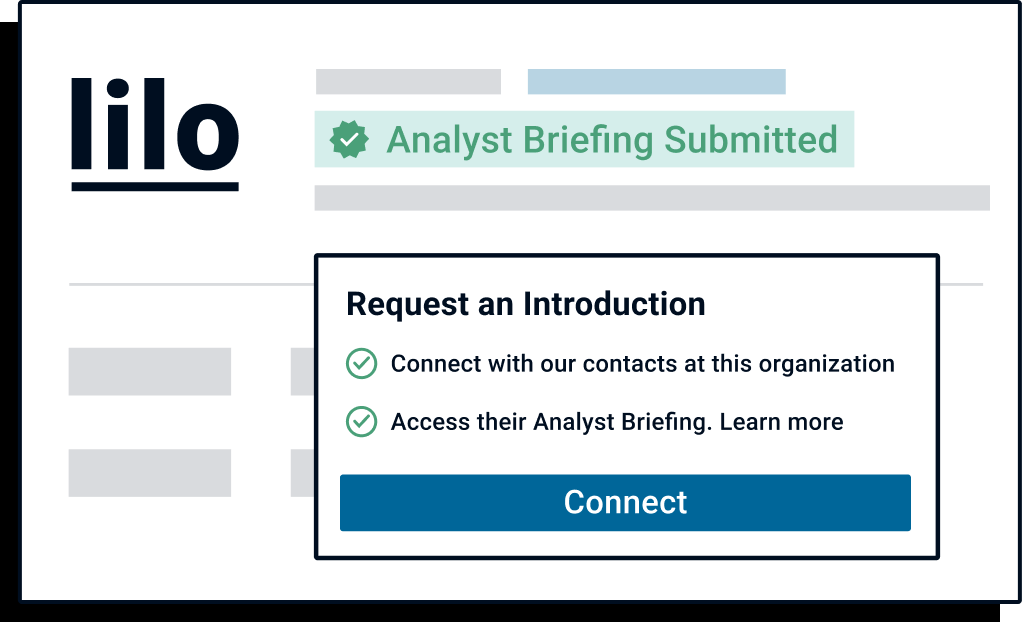

想告知投资者类似积极的基金关于你的公司吗?

提交你的分析师简报在投资者面前,CB Insights的平台上的客户和合作伙伴。德赢体育vwin官方网站

最新的积极的基金新闻

2023年4月5日

X ByLu王你的文章被成功与你提供的联系人。专业选股人已经在去年的波动被定位为更多相同的标题到2023年。他们有完全不同的东西,支付他们的回报。只有三分之一的积极管理型基金第一季度股市基准,自2020年底以来的最差表现。美国银行(Bank of America corp .)编制的数据显示。这与2022年的47%的命中率是最好的五年。最活跃的基金因其偏向银行适得其反多个区域银行和池后获胜的股票在日益不稳定的市场萎缩。增加的不幸是一个谨慎的定位,证明了不合时宜的意外股本。“情绪悲观走向,把活跃的基金可能会措手不及市场反弹,”美国银行策略师包括Savita Subramanian在一份报告中写道。现金已经成为华尔街的青睐的对冲工具后2022年的熊市。在最新的美国银行(Bank of America corp .)基金经理的调查中,现金水平连续15个月超过5%,自2002年以来最长的运行。 While cash yielding 5% a year is not trivial, it fell short of the 7% gain in the first quarter from the benchmark S&P 500. To be sure, even the most successful stock pickers trail the market from time to time, and all the caution may end up being prescient given the ominous backdrop facing risky assets, from monetary tightening to earnings downgrades and elevated equity valuations. Yet the lousy start for active management is a departure from last year, when stock pickers managed to shine during the market selloff. Any further underperformance would weaken their position in an uphill battle against the rise of passive investing. The Latest Adding to the pain were wrong-footed industry wagers. At the start of the quarter, large-cap core funds favored financial shares more than any other major groups except for industrials, according to Goldman Sachs Group Inc. data. Technology, on the other hand, was the least popular. The actual sector performance turned out to be almost the exact opposite. Financial shares ranked at the bottom of the 11 S&P 500 industries, losing 6%, as bank failures spurred concern over the industry’s health. Meanwhile, money sought safety in cash-rich companies, sparking a 21% surge in tech. All told, a Goldman basket of mutual funds’ most-favored stocks trailed their least-favored by 7.5 percentage points during the first quarter. “Mutual funds materially underperformed recently due to their overweight in financials and underweight allocation to mega-cap tech,” Goldman strategists including David Kostin wrote in a note in late March. The list of market-beating stocks that money managers can choose from is dwindling. This year, only 33% of members in the Russell 3000 have outperformed, compared with 47% in 2022. And many of the big winners are concentrated in one industry: tech. To see the challenge facing stock pickers, consider this statistics: while the Russell 3000 was up 6.7% in the first quarter, the tech-heavy Nasdaq 100 surged 20%. That’s the widest spread in favor of the latter since 2001. “Narrow breadth was a headwind for active funds,” said BofA’s Subramanian. (Image: Shutterstock)

活跃的基金投资

2投资

积极的基金了2投资。他们最新的投资清晰的运动作为他们的一部分系列A - 3在2022年8月8日。

活跃的基金投资活动

日期 |

轮 |

公司 |

量 |

新的吗? |

共同投资者 |

来源 |

|---|---|---|---|---|---|---|

|

8/24/2022 |

系列A - 3 |

清晰的运动 |

9.6美元 |

是的 |

2 |

|

|

11/11/2021 |

一个系列 |

发现正确的解决方案为您的团队

CB见解德赢体育vwin官方网站科技市场情报平台分析数百万数据点在供应商、产品、合作关系,专利来帮助您的团队发现他们的下一个技术解决方案。