Investments

28Portfolio Exits

4Funds

6About SeaChange Fund

The Seattle Angel Fund is focused on investments in Pacific Northwest growth-oriented start-up companies. SAF aims to drive economic growth and prosperity through excellent investment opportunities for investors and continuous and valuable support of portfolio companies.

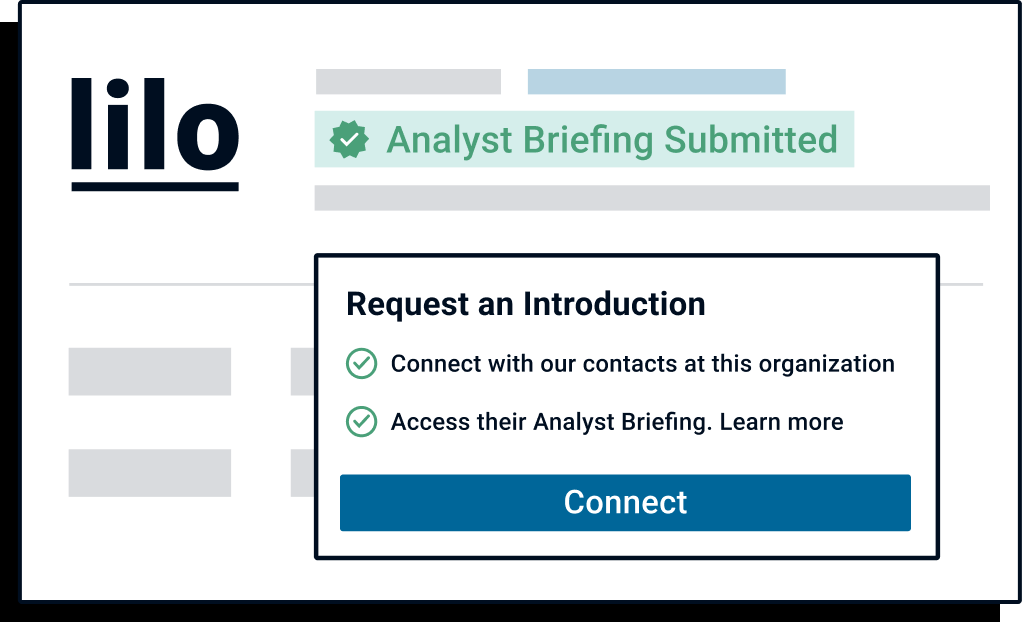

Want to inform investors similar toSeaChange Fundabout your company?

Submit your Analyst Briefing to get in front of investors, customers, and partners on CB Insights’ platform.

LatestSeaChange FundNews

Mar 30, 2023

一轮融资领导Payscore宣布关闭by ffVC. Payscore – a FinTech company automating income verification for property managers and consumer lenders – announced the successful close of a financing round led by ffVC of New York, with SeaChange Fund, Hamilton Ventures, and Seattle’s Alliance of Angels joining the funding. Founded with the goal of accelerating a delay-ridden process while maximizing accuracy and minimizing liability risk, Payscore automates income verification, slashing an hour or more from time spent processing every application. And Payscore produces accurate reports at a rate 2-3X the competition. The process of relying on pay stubs to verify income leads to problems. Inaccurate and unfair income assessments are frequently subject to delay and often leave operators exposed to fraud and liability risk. And so in response, the company co-founders Fiebig and Arifin developed a solution delivering accuracy by design. This is an essential market to pursue as the U.S. residential rental market comprises of about 44 million units with an average turnover of 3 years and multiple applications per vacancy. Payscore has decades of experience in the property management and software industries. And the company co-founder and CEO Mark Fiebig succeeded in leadership roles at venture-backed and self-funded technology startups in several sectors including in real estate and specifically in property management and vehicle dealership operations. And Payscore CTO and co-founder Stephen Arifin and his engineering team provide technological leadership, having successfully shipped multiple products inside Microsoft, Amazon, and Meta. The additional members of the team each have over 30 years of directly relevant expertise. KEY QUOTES: “Verification of income deserves disruption on both sides of the transaction. We’re making it simple for applicants and operators to easily share and accurately assess the truth about income.” — Mark Fiebig, CEO and co-founder of Payscore “We’re excited about our solution’s ability to slash wasted time. Creating efficiency while ensuring fairness for hard-working people motivates our engineers every day.” — Stephen Arifin, Payscore’s CTO and co-founder “When verifying income, accuracy is everything. By analyzing consumer-permission data, Payscore ensures every applicant is evaluated fairly and objectively, even when income is cash-based, like tips, or fluctuates, like commissions.” Payscore eliminates a root source of fraud by integrating directly with financial institutions, reporting 100% bank-verified data and eliminating the need to collect and evaluate financial documents, or to guess whether those documents have been falsified. Fiebig commented, “We deliver the truth about income.” — Alex Katz, MD Partner at ffVC and Payscore board member “Rental demand exceeded supply for the last 10 years, persistently 35% of us are renters, and the market for income verification is large, growing, and self-renewing. The emerging dynamics of the modern workforce, inflation, and interest rate pressures create demand for property managers to reduce costs by automating processes, broadly increasing the value of Payscore’s solution.” — Prashant Kothari, MD of Hamilton Ventures, and the newest investor in Payscore Trending on Pulse 2.0

SeaChange Fund Investments

28 Investments

SeaChange Fund has made28 investments.Their latest investment was inPayscoreas part of theirSeed VConFebruary 2, 2023.

SeaChange Fund Investments Activity

Date |

Round |

Company |

Amount |

New? |

Co-Investors |

Sources |

|---|---|---|---|---|---|---|

|

2/14/2023 |

Seed VC |

Payscore |

$2.27M |

Yes |

2 |

|

|

1/31/2023 |

Seed VC |

Cleary |

$4.5M |

Yes |

7 |

|

|

11/15/2022 |

Seed VC |

CalmWave |

$4M |

Yes |

AI2 Incubator,Bonfire Ventures,Hike Ventures,SeaChange Fund,Tau Ventures,andUndisclosed Angel Investors |

6 |

|

6/29/2022 |

Series A |

|||||

|

5/19/2021 |

Seed VC - II |

Date |

2/14/2023 |

1/31/2023 |

11/15/2022 |

6/29/2022 |

5/19/2021 |

|---|---|---|---|---|---|

Round |

Seed VC |

Seed VC |

Seed VC |

Series A |

Seed VC - II |

Company |

Payscore |

Cleary |

CalmWave |

||

Amount |

$2.27M |

$4.5M |

$4M |

||

New? |

Yes |

Yes |

Yes |

||

Co-Investors |

AI2 Incubator,Bonfire Ventures,Hike Ventures,SeaChange Fund,Tau Ventures,andUndisclosed Angel Investors |

||||

Sources |

2 |

7 |

6 |

SeaChange FundPortfolio Exits

4 Portfolio Exits

SeaChange Fundhas4portfolioexits. Their latest portfolio exit wasGive InKind onDecember 05, 2022.

Date |

Exit |

Companies |

Valuation

Valuations are submitted by companies, mined from state filings or news, provided by VentureSource, or based on a comparables valuation model.

|

Acquirer |

Sources |

|---|---|---|---|---|---|

|

12/5/2022 |

Acquired |

3 |

|||

Date |

12/5/2022 |

|||

|---|---|---|---|---|

Exit |

Acquired |

|||

Companies |

||||

Valuation |

||||

Acquirer |

||||

Sources |

3 |

SeaChange FundFund History

6 Fund Histories

SeaChange Fundhas6 funds, includingSeachange Fund VI.

Closing Date |

Fund |

Fund Type |

Status |

Amount |

Sources |

|---|---|---|---|---|---|

|

5/21/2020 |

Seachange Fund VI |

|

|

$1.11M |

1 |

|

1/21/2020 |

SeaChange Fund V |

||||

|

6/7/2018 |

SeaChange Fund IV |

||||

|

6/12/2017 |

Seattle Angel Fund III |

||||

|

1/24/2017 |

Seattle Angel Fund II |

Closing Date |

5/21/2020 |

1/21/2020 |

6/7/2018 |

6/12/2017 |

1/24/2017 |

|---|---|---|---|---|---|

Fund |

Seachange Fund VI |

SeaChange Fund V |

SeaChange Fund IV |

Seattle Angel Fund III |

Seattle Angel Fund II |

Fund Type |

|

||||

Status |

|

||||

Amount |

$1.11M |

||||

Sources |

1 |

SeaChange FundTeam

3 Team Members

SeaChange Fundhas3 team members,including,.

Name |

Work History |

Title |

Status |

|---|---|---|---|

|

William Finney |

Founder |

Current |

|

Name |

William Finney |

||

|---|---|---|---|

Work History |

|||

Title |

Founder |

||

Status |

Current |

Discover the right solution for your team

The CB Insights tech market intelligence platform analyzes millions of data points on vendors, products, partnerships, and patents to help your team find their next technology solution.