FINQware

Founded Year

2017Stage

Convertible Note | AliveTotal Raised

$1.69MValuation

$0000Last Raised

$520K | 9 mos agoAbout FINQware

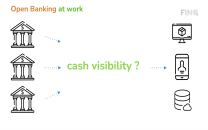

FINQware develops technologies and products for open banking. The company's main product, FinqTreasury, is an open banking system for treasury, accounting, and payment automation, based on SaaS and API solutions. FINQware was founded in 2017 and is based in Bucharest, Romania.

FINQware's Product Videos

Compete withFINQware?

Ensure that your company and products are accurately represented on our platform.

FINQware's Products & Differentiators

Finq Treasury

Finqware开放银行业中间件连接到我mportant banks in CEE, providing relevant coverage for companies working with multiple banks. FinqTreasury is our customer facing solution, providing a unique centralized view to all their bank accounts. The FinqTreasury solution gives treasury and accounting teams the real-time power of the APIs and the most intuitive experience for automated cash management, payments and uninterrupted connection to all their banks.

Expert Collections containing FINQware

Expert Collections are analyst-curated lists that highlight the companies you need to know in the most important technology spaces.

FINQware is included in2 Expert Collections,includingBanking.

Banking

976 items

Fintech

5,143 items

Track and capture company information and workflow.

LatestFINQwareNews

Feb 14, 2023

Abonează-te pe Nepi Rockcastle, a premier owner and operator of shopping centres in Central and Eastern Europe, implemented the Citibank’s global CitiConnect API solution in FinqTreasury, a next generation treasury management automation platform, developed by Finqware. This is the first successful live integration of CitiConnect API connectivity with a fintech platform in Romania and Bulgaria and one of the very first in Central Europe. Such solution offers to NEPI Rockcastle full visibility on cash accounts and real time information on the banking transactions consolidated across the group in one platform. NEPI Rockcastle aims to conclude partnerships with fintech start-ups operating in the CEE region to scale its real estate business and meet the demands of the modern world. The partnering with Finqware represents one step ahead on this strategic path with a focus to enhance the Group’s automated operations and create new opportunities for experience sharing and innovation. ”When learning about Open Banking, we anticipated the opportunity offered by API technologies to access bank accounts and related data in real time, in an automated and consolidated way. We understood that this could drive forward our financial operations efficiency with an optimal cost. The fact that Citibank, one of our key Group’s banking partners, goes even further by offering advanced data connectivity through customized API channel, was a pleasant surprise. We are keen to leverage this successful integration implemented by Finqware for our operational use”, declared Adela Tapurin, Treasury Director at NEPI Rockcastle. As more Central European companies expand into new countries, Citi is supporting their growth and further automating their cash management operations, including supporting the Shared Service Centers being set up in the region. Innovative solutions such as CitiConnect API illustrates Citi’s commitment and investments to improving the client experience and enhancing the technology infrastructure. Providing a direct connection to Citi from an enterprise-wide treasury management, ERP and other cash management systems, CitiConnect simplifies and speeds bank integration, and streamlines the file exchange and messaging processes, reducing costs using automated processing and expediting dispute resolutions associated with cash management needs. ”We believe in technology and that our customers should use any digital transformation opportunity to build financial and operational advantages. The rapidly evolving business environment, including direct-to-consumer flows, new e-commerce models, increasing adoption of instant payments and the greater necessity of real time information is changing the needs that companies have and how quickly they can rely on data. The CitiConnect API that Nepi Rockcastle adopted is a very good example of an ‘off the shelf’ solution that Citi provides to its customers globally, enabling them to initiate payments and retrieve account statements. Although initially is started with the Bulgarian bank accounts integration, the solution helped connect all Citi accounts Nepi Rockcastle has across the countries where it operates together, improving visibility and control”, stated Andrei Stoian - TTS Country Head at Citibank Europe plc, Bulgaria Branch. Finqware, an European fintech headquartered in Romania, authorized as a payment institution under PSD2, launched last year its cloud-based treasury automation platform - FinqTreasury and integrated CitiConnect API as a built-in bank connector into its multi-bank connectivity platform for corporate. Thus, Finqware is able to provide its corporate customers not only with regulatory bank connectors across PSD2 footprint but also with custom and premium bank API solutions. ”Catering for the needs of a leading real estate Group, operating in 9 CEE countries and transacting in 7 currencies, such as Nepi Rockcastle, requires a large bank connectivity footprint as well as multiple technical solutions for bank integration. FinqTreasury provides a seamless, bank-agnostic connection, and CitiConnect® API is a full-service API to exchange data with the bank on behalf of our clients”, said Cosmin Cosma, Co-founder and CEO of Finqware. Recomandarile noastre:

FINQwareFrequently Asked Questions (FAQ)

When was FINQware founded?

FINQware was founded in 2017.

Where is FINQware's headquarters?

FINQware's headquarters is located at 21 Elena Caragiani Street, 8, Bucharest.

What is FINQware's latest funding round?

FINQware's latest funding round is Convertible Note.

How much did FINQware raise?

FINQware raised a total of $1.69M.

Who are the investors of FINQware?

Investors of FINQware include Seedblink, 7XPartners, Gap Minder, Elevator Ventures, InnovX BCR Accelerator and 4 more.

Who are FINQware's competitors?

Competitors of FINQware include Nordigen and 4 more.

What products does FINQware offer?

FINQware's products include Finq Treasury and 1 more.

Who are FINQware's customers?

Customers of FINQware include Banca Transilvania and CEC Bank.

Compare FINQware to Competitors

Kyriba offers cloud-based Proactive Treasury Management solutions and delivers cash management technology to CFOs, treasurers, and financial professionals. The company's secure and scalable SaaS treasury, bank connectivity, risk management, and supply chain finance solutions enable organizations to drive corporate growth, obtain critical financial insights, minimize fraud, and ensure compliance.

Meniga builds white-label personal finance management (PFM) and online banking solutions for retail banks. Meniga's digital banking platform helps banks use personal finance data to enrich their online and mobile customer experiences. Meniga has expanded its product offering to include data-driven card-linked offers, personalization, and other user-centric services designed to make online and mobile banking more engaging and useful. Banks can also use Meniga's technology to quickly introduce new services into their digital offerings.

Yolly是财务管理和自动化解放军tform designed to free small and medium-sized enterprises from repetitive admin work. It acts as a financial GPS for small business owners. It utilizes the EU's open banking directive to assist SMEs with financial planning and management and provides a real-time digital advisor. The company was formerly known as Xencio and changed its name to Yolly. It was founded in 2020 and is based in Wien, Austria.

Finmap provides financial management tools for small businesses and entrepreneurs. It provides analysis of business finances such as cash flows and profitability statements and automates financial management routines, by integrations with banks, accounting tools, and customer relationship management (CRM). It was founded in 2017 and is based in Kyiv, Ukraine.

Friday Finance operates as a financial management platform. The company allows access to all bank accounts in one place by providing services such as monitoring cash flow insights, bill pay, accounting automation, and more. It is formerly known as Airbank. It was founded in 2021 and is based in Berlin, Germany.

riskrate predicts customers' payment delays and tells users how their customers are paying their bills to others at the moment.

Discover the right solution for your team

The CB Insights tech market intelligence platform analyzes millions of data points on vendors, products, partnerships, and patents to help your team find their next technology solution.